- Fintech

- Web Development

A Guide to Sustainable Banking Trends in FinTech 2024

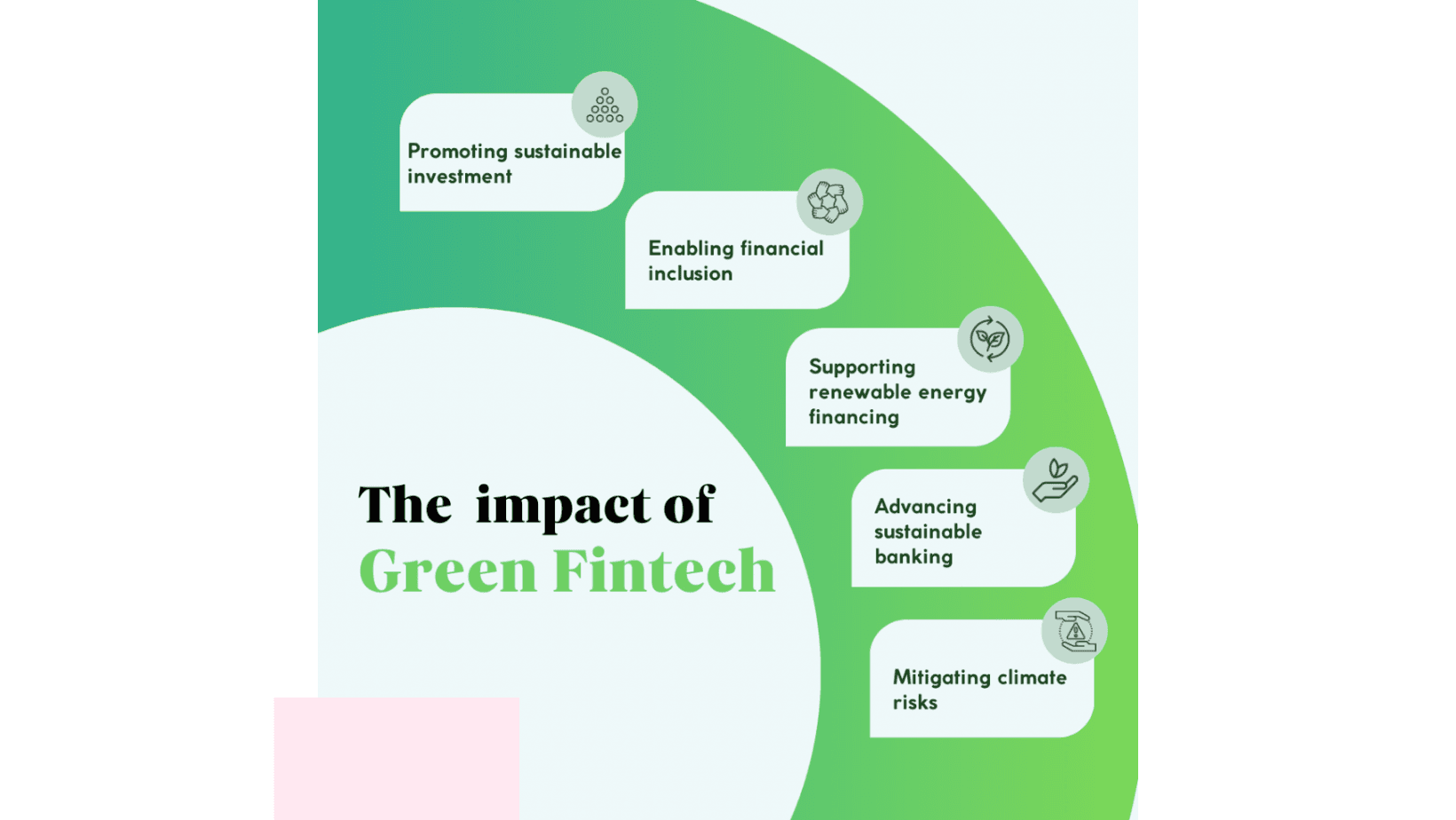

As we traverse the ever-evolving landscape of financial technology (FinTech) in 2024, sustainable banking emerges as a transformative force, reshaping the way we approach finance. This comprehensive guide unravels the key trends driving sustainable banking within the FinTech sector this year. From technological innovations to changing consumer preferences, we'll delve into the nuances of sustainable finance and its profound impact on the financial industry.

Sustainable Investments Steer Financial Portfolios

A significant trend dominating FinTech in 2024 is the surge in sustainable investments. Investors, driven by a heightened environmental and social consciousness, are increasingly seeking portfolios aligned with environmental, social, and governance (ESG) principles. FinTech platforms are responding by providing sophisticated tools that empower users to make informed decisions about eco-conscious investments, marking a pivotal shift toward sustainable wealth management.

Technology as the Enabler of Green Innovation

Technology takes center stage in 2024, acting as a catalyst for sustainable banking innovation. Artificial Intelligence (AI) and machine learning algorithms are harnessed to develop advanced analytics tools that assess the environmental impact of financial decisions. The integration of blockchain technology ensures transparency and traceability in transactions, bolstering the overall integrity of sustainable banking practices.

The Ascendance of Green Bonds and Sustainable Financial Instruments

The financial world witnesses the ascendancy of green bonds as a prominent trend in 2024. These financial instruments, designed to fund environmentally friendly projects, are experiencing unprecedented popularity. FinTech platforms are facilitating the issuance and trading of green bonds, providing investors with avenues to contribute to sustainability while reaping financial returns.

Financial Inclusion with a Conscience

Sustainable banking in 2024 is not merely confined to environmental considerations; it places a strong emphasis on financial inclusion. FinTech platforms are adopting responsible lending practices, incorporating social responsibility criteria into credit assessments. This trend aims to expand access to financial services, particularly for underserved populations, fostering an inclusive and socially responsible financial ecosystem.

Transparency and Global Reporting Standards

A cornerstone of sustainable banking is transparency, and in 2024, there is an increased emphasis on global reporting standards. FinTech platforms are adopting frameworks like the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD) to provide clear and standardized information on their ESG practices. This commitment to transparency enhances trust among stakeholders and contributes to a more accountable financial sector.

The Rise of Sustainable FinTech Startups

The FinTech landscape witnesses a notable rise in startups dedicated to sustainable finance. These startups leverage technology to create innovative solutions that address both financial and environmental challenges. From sustainable investment platforms to eco-friendly payment solutions, these startups contribute to the diversification of sustainable banking offerings, injecting new energy into the FinTech ecosystem.

Collaborative Ecosystems for Green Finance

2024 marks the formation of collaborative ecosystems to promote green finance. FinTech platforms, traditional financial institutions, environmental organizations, and regulatory bodies are coming together to create a shared space for sustainable banking initiatives. This collaborative approach aims to amplify the impact of sustainable finance on a global scale, fostering a sense of collective responsibility.

Customer-Driven Demand for Sustainable Finance

One of the most significant trends in sustainable banking is the increasing demand from customers. In 2024, consumers are more conscious of the environmental and social impact of their financial choices. FinTech platforms respond by offering user-friendly interfaces that provide insights into the ESG performance of investments, empowering users to align their values with their financial decisions.

Regulatory Support for Sustainable Finance

Regulatory bodies worldwide recognize the importance of sustainable finance. In 2024, there is a growing trend of regulatory support for sustainable banking practices. Frameworks, incentives, and guidelines are being developed to encourage financial institutions, including FinTech platforms, to integrate sustainability into their operations. This regulatory backing further legitimizes and propels the sustainable finance movement.

Educational Initiatives Promoting Sustainable Finance Literacy

As awareness of sustainable finance grows, there is an increasing emphasis on educational initiatives. FinTech platforms are incorporating educational features within their interfaces to inform users about the principles of sustainable banking. These initiatives aim to bridge the knowledge gap and empower users to make environmentally conscious financial decisions.

Future Trends for Sustainable Banking Apps: Revolutionizing Green Finance

The future of sustainable banking apps is poised to empower environmentally conscious users and drive positive change. In this exploration of technological innovations shaping the evolving FinTech landscape, we delve into the key trends that will redefine sustainable banking apps in the coming years.

Blockchain for Enhanced Transparency

Sustainable FinTech apps are set to harness the power of blockchain technology, ensuring transparent tracking of financial transactions and supply chains. By adopting blockchain solutions, businesses can provide verifiable and traceable information, fostering trust and facilitating responsible green investments.

AI-Powered Personalized Sustainability Insights

The future of sustainable banking will witness a revolution driven by AI-powered apps. Artificial Intelligence will offer users tailored suggestions for eco-friendly choices. Businesses incorporating AI-driven analytics into their apps will provide personalized insights on reducing carbon footprints, identifying green investment opportunities, and promoting sustainable lifestyle practices.

Carbon Offsetting Integration

Anticipated in the future is the integration of carbon offsetting options within sustainable banking apps. This functionality empowers users to compensate for their carbon footprint while managing their finances, aligning their monetary activities with environmental responsibility.

Collaborative Green Finance Ecosystems

Reports suggest the emergence of collaboration platforms connecting users, businesses, and environmental organizations within the sustainable finance ecosystem. By fostering partnerships and collaborations, businesses can create platforms that encourage collective impact, user engagement, and sustainable financial practices.

Green Investment Robo-Advisors

Green and ethical investments are slated to gain prominence with the rise of robo-advisors specializing in sustainable finance. Businesses can integrate features of green investment robo-advisors into their apps, providing users with automated guidance for making sustainable investment decisions.

Enhanced Data Security Measures

In the future landscape of sustainable banking apps, robust data security will be paramount. Businesses can ensure the security of sensitive financial and personal data by adopting advanced encryption technologies and incorporating biometric authentication features into their apps, building and maintaining user trust.

Gamification for Behavioral Change

Gamification techniques will be strategically employed to incentivize sustainable financial behaviors. Integrating gamified elements into apps, businesses can motivate users to make eco-conscious choices through rewards and challenges, promoting a positive shift in financial behavior.

Impact Measurement and Reporting

The future holds the development of sophisticated impact measurement and reporting tools within sustainable banking apps. By enhancing their apps with these tools, businesses can provide users with detailed insights into the environmental and social impact of their financial decisions, fostering increased transparency and accountability.

Why is CodeNomad Your Trusted Partner for Sustainable Banking App Development?

CodeNomad stands out as your trusted partner for sustainable banking app development, combining cutting-edge technology with a steadfast commitment to environmental and social responsibility. With a proven track record in delivering innovative and sustainable solutions, CodeNomad understands the intricacies of sustainable finance. The team excels in integrating blockchain for enhanced transparency, leveraging AI to provide personalized sustainability insights, and adopting the latest trends in green finance. CodeNomad's expertise extends beyond technology; they actively contribute to the creation of a collaborative green finance ecosystem, ensuring your app aligns seamlessly with future trends. By choosing CodeNomad, you are not just investing in a development partner but embracing a commitment to a greener, more sustainable financial future.

Conclusion: Navigating the Green Financial Landscape of 2024

In conclusion, the landscape of sustainable banking within the FinTech sector is dynamic and evolving in 2024. From the integration of technology to the rise of startups and collaborative ecosystems, the trends outlined in this guide signify a shift towards a more responsible and inclusive financial ecosystem. As consumers, investors, and regulators increasingly prioritize sustainability, FinTech platforms find themselves at the forefront of shaping a green future for the financial industry. By navigating these trends, stakeholders can contribute to a more sustainable and resilient global economy, marking a new era in the intersection of finance and environmental responsibility.

Search

Never Miss A Post!

Sign up for free and be the first to get notified about updates.

Stay In Touch

Sign up for free and be the first to get notified about updates.