- Warranty

- Web Development

- Mobile App Development

How Insurance / Warranty App Development Can Unlock Billions

The insurance industry, long known for its mountains of paperwork and slow turnaround times, is undergoing a digital revolution. Fueled by the ever-present smartphone, mobile apps are shaking up the way insurance companies operate and how customers interact with their policies. These user-friendly apps are streamlining processes, boosting customer satisfaction, and opening doors to entirely new markets.

In this blog post, we'll delve into the reasons why insurance/warranty app development is a critical step for companies looking to capitalize on the multi-billion dollar InsurTech market.

Why Does the Insurance/Warranty Industry Need Mobile Apps?

The traditional insurance landscape is riddled with inefficiencies that leave both companies and customers frustrated. Here's why mobile apps are becoming an essential tool for the industry:

-

Enhanced Customer Engagement: Mobile apps provide a constant connection between insurers and their customers. This 24/7 accessibility fosters stronger relationships, allowing for instant communication, policy updates, and personalized recommendations.

-

Streamlined Processes: Paperwork reduction is a major advantage. Apps can automate tasks like policy renewals, claims filing, and payment processing, saving both companies and customers valuable time.

-

Improved Customer Experience: Mobile apps empower customers with control and convenience. They can easily access policy details, track claims progress, and even get quotes for additional coverage, all from their smartphones.

-

Increased Efficiency: Automating workflows and simplifying processes through apps leads to significant operational cost savings for insurance companies.

-

Data-Driven Insights: Mobile apps can collect valuable data on customer behavior and preferences. This data can be used to personalize offerings, develop targeted marketing campaigns, and ultimately improve risk assessment.

-

Reaching New Markets: The mobile app serves as a gateway to new customer segments, particularly younger demographics who prefer digital interactions. This broadens the reach of insurance companies and fosters industry growth.

These are just some of the compelling reasons why the insurance industry needs mobile apps. By embracing this technology, companies can revolutionize the customer experience, streamline operations, and unlock the full potential of the InsurTech market.

What Type of Insurance Applications Can You Build?

The beauty of mobile app development lies in its versatility. The InsurTech market offers a vast landscape for insurance apps, catering to various needs and functionalities. Here are some prominent examples:

-

Life Insurance Apps: These apps streamline life insurance management, allowing users to view policy details, pay premiums, and even designate beneficiaries directly from their phones. Some apps may integrate financial planning tools or offer educational resources.

-

Health Insurance Apps: Health insurance apps empower users to manage their health plans on the go. They can search for in-network providers, track deductibles and out-of-pocket costs, and even submit claims with photo documentation. Integration with wearable devices for health data tracking is also becoming increasingly popular.

-

Car Warranty Apps: These apps are a must-have for any modern driver. They provide features like accessing proof of insurance documents, roadside assistance requests, and even accident reporting with photo and video capabilities. Some car insurance apps even offer telematics programs that track driving habits and reward safe drivers with discounts.

-

Property & Home Warranty Apps: These apps help homeowners and renters manage their property warranty policies. They can track coverage details, file claims for damage, and even get quotes for additional coverage like flood or earthquake insurance. Some apps offer features like home inventory management and safety tips.

-

Travel Insurance Apps: For frequent travelers, travel insurance apps offer peace of mind. Users can purchase travel insurance plans directly through the app, file claims for trip cancellations or medical emergencies, and access customer support while abroad.

-

Extended Warranty Apps: These apps can be beneficial for managing extended warranties on various products, from appliances to electronics. Users can store product information, track coverage details, and easily initiate claims. Some apps might offer features like repair service scheduling or troubleshooting guides.

This is not an exhaustive list, and the possibilities for insurance app development continue to expand. We can even envision niche apps catering to specific needs, like pet insurance management or cyber-security coverage for businesses.

The key takeaway is that insurance apps can be tailored to address a wide range of customer needs and insurance products. By understanding your target audience and their pain points, you can develop a mobile app that revolutionizes the way they interact with insurance.

How Does an Insurance/Warranty Application Work?

Insurance applications function as a bridge between insurance companies and their customers, offering a convenient and user-friendly platform for managing policies, submitting claims, and accessing essential information. Here's a breakdown of the core functionalities:

-

User Authentication & Onboarding: Users can create accounts securely and link their existing insurance policies to the app.

-

Policy Management: Users can access and view detailed information about their insurance policies, including coverage details, deductibles, and expiry dates.

-

Claims Processing: The app streamlines the claims filing process, allowing users to submit claims electronically, upload supporting documents (photos, receipts), and track the claim status in real-time.

-

Premium Payments: Users can conveniently pay their insurance premiums directly through the app using secure payment gateways.

-

Customer Support: The app provides access to customer support channels like live chat, email, or phone for users to ask questions and get assistance.

These core functionalities form the foundation of any insurance application. However, the specific features can be further customized depending on the type of insurance offered.

General Features of an Insurance/Warranty Application:

- Push Notifications: Keep users informed about policy updates, claim statuses, upcoming renewals, and promotional offers.

- Document Management: Allow users to securely store and access important documents related to their policies.

- Geolocation Services: Utilize location data for features like finding nearby in-network providers (health insurance) or requesting roadside assistance (car insurance).

- Security & Privacy: Ensure robust security measures to protect user data and comply with relevant data privacy regulations.

Feature List for Admin Panel (Example-Based):

The admin panel empowers insurance companies to manage user accounts, policies, claims, and app functionalities. Here's how the features might differ based on the type of insurance:

1. Car Warranty:

- Manage driver profiles and vehicle information.

- Process accident reports and claims.

- Analyze driving data (if using telematics programs).

- Offer roadside assistance dispatch services.

2. Health Insurance:

- Manage provider networks and access to healthcare facilities.

- Process health insurance claims for various medical services.

- Analyze health data trends (if integrated with wearable devices).

- Provide customer support for medical billing inquiries.

3. Life Insurance:

- Manage beneficiary information and policy payouts.

- Offer tools for financial planning and estate management.

- Analyze mortality data and risk assessment.

- Manage communication with beneficiaries in case of a claim.

4. Extended Electronics Warranty:

- Manage product information and coverage details for various electronics.

- Submit and track warranty claims for repairs or replacements.

- Schedule repair services or access troubleshooting guides (if offered).

- Provide contact information for warranty providers and customer support.

These are just a few examples, and the specific features of the admin panel will vary depending on the insurance company's needs and the type of coverage offered.

By incorporating these functionalities, insurance applications can revolutionize the way customers interact with their policies, ultimately leading to a smoother and more efficient experience for all parties involved.

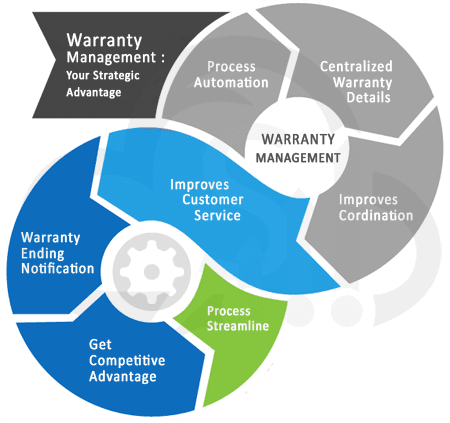

Digital Transformation, Warranty Mobile Apps, and InsurTech: Understanding the Nuances

These terms are all interconnected within the insurance industry, but they represent distinct concepts:

-

Digital Transformation: This is a broad term encompassing the overall shift from traditional, analog business practices to leveraging digital technologies. In the context of insurance, this could involve everything from automating back-office processes to implementing online policy management systems. Insurance mobile apps are a key component of this digital transformation, providing a user-friendly platform for customer interaction.

-

Warranty Mobile App: This is a specific software application designed for smartphones and tablets. It allows insurance companies to connect with their customers on a mobile platform, offering features like policy management, claims filing, and premium payments. Insurance mobile apps are a product of digital transformation efforts and play a crucial role in improving customer experience and streamlining processes.

-

InsurTech: This term is a combination of "insurance" and "technology." It refers to the entire ecosystem of companies and startups that are leveraging technology to innovate and disrupt the traditional insurance industry. InsurTech companies develop a wide range of solutions, including insurance mobile apps, data analytics tools for risk assessment, and even entirely new insurance products tailored to the digital age.

Cutting-Edge Technologies to Gain a Competitive Edge in Insurance/Warranty Technology (InsurTech)

The InsurTech landscape is brimming with innovation. While insurance mobile apps are a foundational element, companies that truly want to stand out need to explore the potential of cutting-edge technologies. Here are some key areas that can give you a competitive edge:

1. Artificial Intelligence (AI) & Machine Learning (ML): AI and machine learning algorithms can be harnessed for a variety of purposes, including:

- Automated Underwriting: Analyze vast amounts of data to streamline risk assessment and personalize insurance premiums for each customer.

- Fraud Detection: Identify and prevent fraudulent claims with greater accuracy using AI's pattern recognition capabilities.

- Chatbots & Virtual Assistants: Offer 24/7 customer support through AI-powered chatbots that can answer questions and resolve simple issues.

2. Internet of Things (IoT) & Telematics: By integrating data from connected devices like wearables or smart home sensors, insurers can:

- Personalized Risk Assessment: Analyze driving habits (telematics) or health data (wearables) to offer discounts to safe drivers or healthy individuals.

- Usage-Based Insurance (UBI): Tailor premiums based on actual usage (e.g., pay-per-mile car insurance).

- Preventative Maintenance: Use smart home sensors to detect potential risks like water leaks and offer preventative maintenance recommendations to policyholders.

3. Blockchain Technology: This secure, distributed ledger system can revolutionize several aspects of insurance:

- Smart Contracts: Automate claim processing and payouts, streamlining the process and reducing administrative costs.

- Improved Data Security: Enhance data security and transparency within the insurance ecosystem.

- Fraud Prevention: Utilize blockchain's immutability to create a tamper-proof record of claims history, making fraud more difficult.

4. Big Data & Data Analytics: Leveraging vast datasets allows insurers to:

- Targeted Marketing & Customer Segmentation: Develop personalized insurance products and marketing campaigns based on customer data and risk profiles.

- Predictive Analytics: Anticipate potential risks and proactively offer preventative measures to policyholders.

- Improved Pricing Models: Analyze historical data to develop more accurate and competitive insurance pricing.

By embracing these cutting-edge technologies, InsurTech companies can gain a significant competitive edge. They can offer a more personalized and efficient customer experience, reduce costs, and ultimately revolutionize the way insurance works for everyone.

What Technology Stack to Use to Build an Insurance App?

Choosing the right technology stack is crucial for building a secure, scalable, and user-friendly insurance app. Here's a breakdown of the key components to consider:

1. Front-End Development:

a. Programming Languages:

- Native Development: For a truly native experience on specific platforms (iOS/Android), consider using platform-specific languages like Swift (iOS) or Kotlin (Android). This offers optimal performance and access to all device functionalities.

- Cross-Platform Development: If you want to reach a wider audience with a single codebase, frameworks like React Native or Flutter can be a good choice. They allow for building apps that work seamlessly on both iOS and Android while maintaining a native feel.

b. UI Frameworks: Libraries like React or Flutter (for cross-platform) or UIKit (iOS) and Jetpack Compose (Android) can help you build user interfaces that are visually appealing and user-friendly.

Back-End Development:

a. Programming Languages:

- Scalable & Secure Languages: Languages like Java, Python, or Node.js are popular choices due to their scalability, security features, and large developer communities.

b. Back-End Frameworks: Frameworks like Spring Boot (Java) or Django (Python) can streamline back-end development by providing pre-built functionalities for common tasks like database access and API creation.

c. Databases: Secure and reliable databases are essential for storing user data, policy information, and claims history. Popular options include SQL databases like MySQL or PostgreSQL, or NoSQL databases like MongoDB for specific needs.

Additional Considerations:

- APIs (Application Programming Interfaces): These will allow your app to integrate with various external services, such as payment gateways, fraud detection tools, or third-party data providers.

- Security: Robust security measures are paramount in the insurance industry. Implement strong encryption protocols, user authentication methods, and regular security audits to protect sensitive user data.

- Cloud Platforms: Cloud platforms like Google Cloud Platform (GCP), Amazon Web Services (AWS), or Microsoft Azure offer scalable and cost-effective solutions for hosting your insurance app and managing its infrastructure.

Choosing the Right Tech Stack:

The optimal technology stack for your insurance app depends on several factors, including:

- Project Scope & Complexity: Simple apps might require a less complex stack, while feature-rich apps may benefit from a more robust foundation.

- Target Platforms: Are you building a native app for iOS or Android, or aiming for a cross-platform solution?

- Development Team Expertise: Consider the skills and experience of your development team when choosing technologies.

- Budgetary Constraints: The cost of development can vary depending on the chosen technologies and development approach.

By carefully considering these factors, you can select a technology stack that empowers you to build a secure, scalable, and user-friendly insurance app that meets your specific needs and drives success in the competitive InsurTech market.

The Insurance App Development Process: From Concept to Launch

Developing a successful insurance app requires careful planning, execution, and ongoing optimization. Here's a breakdown of the key stages involved in the process:

1. Discovery & Planning:

-

Market Research & Competitive Analysis: Start by thoroughly researching your target audience, understanding their needs and pain points. Analyze existing insurance apps to identify best practices and potential gaps in the market.

-

Define App Concept & Functionality: Clearly define the purpose and functionalities of your insurance app. What specific problems will it solve for users? What features will differentiate it from competitors?

-

Develop User Personas & User Stories: Create user personas to represent your target audience and user stories outlining their interactions with the app. This helps ensure the app caters to user needs and is intuitive to navigate.

-

Project Scope & Timeline Estimation: Define the development scope, outlining the features to be included in the initial version and potential future iterations. Create a realistic timeline and budget for the entire development process.

2. Design & Prototyping:

-

Information Architecture (IA) & User Interface (UI) Design: Develop a user-friendly information architecture that organizes content logically and facilitates easy navigation. Design a visually appealing and intuitive user interface that prioritizes usability and a positive user experience.

-

User Interface (UI) Prototyping: Create interactive prototypes that simulate the app's functionality and user flow. This allows for user testing and feedback before investing significant resources in development.

3. Development & Testing:

-

Back-End Development: Build the core functionalities of the app, including secure data storage, user authentication, API integrations, and any necessary server-side logic.

-

Front-End Development: Develop the user interface based on the approved designs, ensuring it functions seamlessly across chosen platforms (iOS/Android or cross-platform).

-

Quality Assurance (QA) Testing: Conduct rigorous testing throughout the development process to identify and fix bugs, ensuring the app functions as intended on all targeted devices.

4. Launch & Deployment:

-

App Store Optimization (ASO): Optimize your app listing for relevant keywords in the App Store (iOS) or Google Play Store (Android) to improve discoverability.

-

App Launch & Marketing: Develop a comprehensive marketing strategy to reach your target audience and generate excitement for your app's launch.

-

Analytics & Monitoring: Continuously monitor app performance through analytics tools to identify areas for improvement and gather user feedback for future updates.

5. Maintenance & Updates:

-

Bug Fixes & Security Updates: Proactively address any bugs or security vulnerabilities reported by users. Regular security updates are crucial to maintain user trust and data protection.

-

New Feature Development: Based on user feedback and market trends, consider developing new features to enhance functionality and user experience.

-

App Version Updates: Regularly release app updates that address bugs, incorporate new features, and optimize performance for the latest devices and operating systems.

By following a structured development process and prioritizing user experience, you can create a successful insurance app that empowers your business to thrive in the dynamic InsurTech landscape.

The Cost of Developing an Insurance Mobile Application

The cost of developing an insurance mobile application can vary significantly depending on several factors. Here's a breakdown of the key elements that influence the overall budget:

-

App Complexity & Features: Simple apps with basic functionalities like policy management and claims filing will naturally cost less compared to feature-rich apps with functionalities like AI-powered chatbots, telematics integration, or real-time claim processing.

-

Development Approach:

a. Native App Development: Building separate native apps for iOS and Android will typically be more expensive due to the need for two development teams with platform-specific expertise.

b. Cross-Platform Development: Utilizing frameworks like React Native or Flutter can be a cost-effective option, allowing you to build a single codebase that functions on both iOS and Android. However, this approach might have limitations in terms of accessing all native device functionalities.

-

Development Team Location & Rates: The hourly rates of developers can vary depending on their location and experience. Hiring a team in a region with lower development costs can be a budget-conscious approach, but it might be crucial to consider factors like communication and time zone differences.

-

Security & Compliance: The insurance industry has strict data security and privacy regulations. Implementing robust security measures and ensuring compliance with relevant regulations can add to the development cost.

-

UI/UX Design: A user-friendly and visually appealing design is essential for any successful app. The complexity of the design and the experience level of the design team will influence the design costs.

-

Back-End Infrastructure: The cost of hosting your app's back-end infrastructure, including servers and databases, needs to be factored in. Cloud platforms like Google Cloud Platform (GCP) or Amazon Web Services (AWS) offer scalable and cost-effective solutions.

Cost Estimates:

It's difficult to provide a one-size-fits-all answer to the cost of developing an insurance app. However, here's a general range to give you a starting point:

- Simple App: $30,000 - $60,000

- Moderately Complex App: $70,000 - $165,000

- Highly Complex App: $170,000 - $250,000+

Remember, these are just estimates. The actual cost of your app can be higher or lower depending on the factors mentioned above.

Here are some additional tips for managing your insurance app development budget:

-

Start with a Minimum Viable Product (MVP): Develop a core version of your app with essential features and gradually add functionalities based on user feedback and market response. This allows you to test your concept and validate your market fit before investing heavily in a full-fledged app.

-

Compare Quotes from Different Development Teams: Get quotes from several mobile app development companies to compare rates and expertise.

-

Clearly Define Your Project Scope: The clearer your vision for the app's functionalities and features, the more accurate estimations you can receive from developers.

By carefully considering these factors and planning your budget strategically, you can develop a successful insurance mobile application that meets your business goals without breaking the bank.

Conclusion

In conclusion, the insurance industry is undergoing a digital revolution fueled by the ubiquitous mobile app. By embracing insurance app development, companies can unlock a wealth of benefits, from streamlining operations and enhancing customer experience to reaching new markets and capitalizing on the multi-billion dollar InsurTech opportunity.

This blog post has explored the key drivers behind this trend, delving into the various types of insurance apps, their functionalities, and the technologies that power them. We've also outlined the development process, from initial concept to launch, and provided insights into budgeting for your insurance app project.

The future of insurance lies in mobility and innovation. By harnessing the power of cutting-edge technologies like AI, big data, and blockchain, insurance companies can develop intelligent and personalized insurance apps that redefine customer interactions and propel the industry forward. Are you ready to take your insurance business mobile? With careful planning, the right technology stack, and a focus on user experience, you can develop a successful insurance app that stands out in the InsurTech marketplace.

Search

Never Miss A Post!

Sign up for free and be the first to get notified about updates.

Stay In Touch

Sign up for free and be the first to get notified about updates.